Navigating the world of finance can feel overwhelming, especially when it comes to choosing the right financial advisor. Understanding how to find a financial advisor is crucial for securing your financial future and achieving your personal goals. Whether you’re planning for retirement, saving for a home, or simply looking to grow your wealth, the right advisor can make all the difference. In this article, we’ll break down the key steps to identify a trustworthy and competent financial partner, empowering you to take control of your financial journey with confidence.

Understanding the Role of a Financial Advisor

What Services Do Financial Advisors Provide?

Financial advisors play a pivotal role in helping individuals manage their personal finances effectively. They offer a diverse range of services tailored to meet the specific needs of their clients. Here’s a quick overview of the services financial advisors typically provide:

| Service | Description |

|---|---|

| Investment Management | Managing client portfolios for optimal returns. |

| Retirement Planning | Assisting clients in preparing for their retirement years. |

| Tax Planning | Developing strategies to minimize tax liabilities. |

| Estate Planning | Helping clients plan for the distribution of their assets after death. |

| Cash Flow Management | Analyzing spending habits and improving savings rates. |

Additionally, financial advisors offer guidance on complex financial situations, such as managing debt or navigating significant life events.

“A good financial advisor not only helps you manage your wealth but also aids in planning for your future.”

Key Areas of Financial Advice

When looking for a financial advisor, it’s important to understand the key areas in which they can provide support. Here are some critical aspects to consider:

- Investment Strategies: Tailored investment plans based on individual risk tolerance and financial goals.

- Retirement Accounts: Guidance on setting up and maximizing contributions to retirement accounts like 401(k)s or IRAs.

- Insurance Needs: Recommendations for life, health, and property insurance to protect assets.

- Debt Management: Strategies to effectively manage and pay down debts.

- Budgeting and Saving: Tools and advice for creating a sustainable budget and achieving savings goals.

Types of Financial Advisors

Selecting the right type of financial advisor is a pivotal step in the process of how to find a financial advisor. Here are the main types you might encounter:

Fiduciary vs. Non-Fiduciary Advisors

- Fiduciary Advisors: Legally obligated to act in the best interest of their clients. They typically charge fees based on a percentage of assets under management (AUM) or flat fees.

- Non-Fiduciary Advisors: May have conflicts of interest as they could earn commissions on products they sell. This can sometimes lead to less favorable advice for clients.

Robo-Advisors vs. Human Advisors

- Robo-Advisors: Automated platforms that use algorithms to offer investment services at a lower cost. Great for those seeking a low-cost option.

- Human Advisors: Provide personalized advice and tailored financial planning, which can be crucial for complex financial situations.

How to Find a Financial Advisor for Your Needs

Assessing Your Financial Situation

Before you begin your search for a financial advisor, it’s essential to assess your own financial situation. Understanding where you stand financially will help you find a professional suited to your needs.

Identifying Your Financial Goals

- Short-Term Goals: Consider what you want to achieve in the next few years (e.g., saving for a vacation, buying a car).

- Medium-Term Goals: Think about plans that will take five to ten years (e.g., purchasing a home, funding education).

- Long-Term Goals: Define your retirement plans and any legacy goals.

Understanding Your Risk Tolerance

Your risk tolerance will dictate the type of investments you’re comfortable with. It’s crucial to have a clear understanding of:

- Conservative: Preferring safer investments with lower returns.

- Moderate: Willing to accept some risk for potential higher returns.

- Aggressive: Comfortable with high-risk investments for the potential of significant gains.

Creating a List of Potential Advisors

Once you’ve assessed your financial situation, the next step is to create a list of potential advisors.

Using Professional Networks

- Referrals: Ask friends, family, or colleagues for recommendations.

- Professional Associations: Check directories of certified financial planners or fiduciary advisors from organizations like the National Association of Personal Financial Advisors or the Certified Financial Planner Board.

Online Research and Reviews

- Websites: Utilize platforms like SmartAsset and NerdWallet to compare advisors.

- Reviews: Read client reviews to gauge the quality of services provided.

Evaluating Financial Advisors

Questions to Ask Potential Advisors

Before making a selection, it’s important to ask potential advisors the right questions. Here’s a list to guide you:

- What is your fee structure? (Understanding management fees, flat fees, and hourly rates).

- Are you a fiduciary? (Ensure they are legally required to act in your best interests).

- What services do you offer? (Verify if they align with your needs).

- How will you communicate with me? (Discuss methods and frequency of communication).

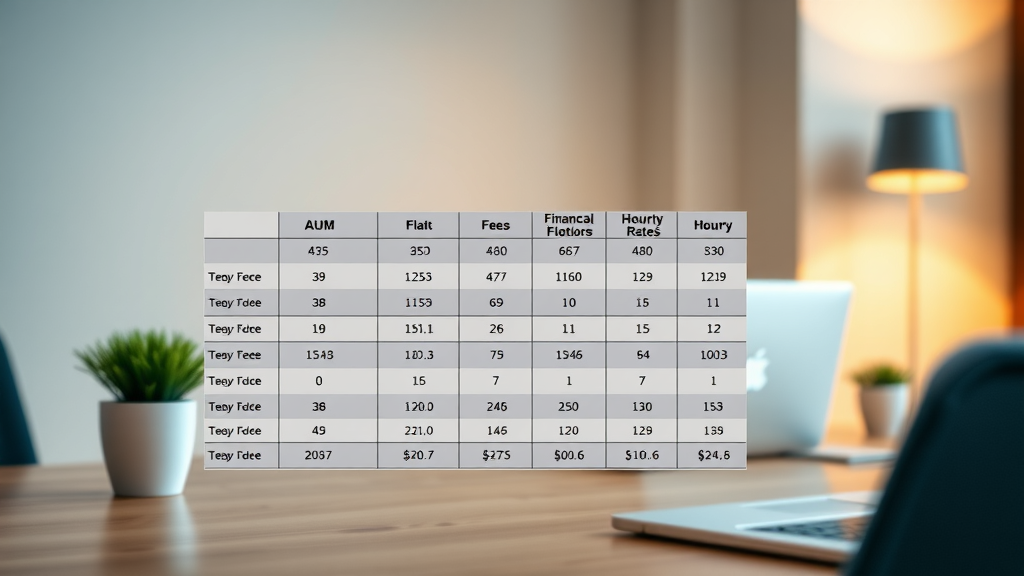

Understanding Fee Structures

Advisors can charge fees in various ways:

| Fee Type | Description |

|---|---|

| Asset Under Management (AUM) | A percentage of the total assets managed. |

| Flat Fee | A fixed fee for services provided. |

| Hourly Rate | Charged for the time spent on services. |

Red Flags to Look Out For

Be cautious when evaluating potential advisors. Here are some red flags to watch for:

- Lack of Transparency: If an advisor is unwilling to disclose their fees or how they are compensated.

- High Pressure Tactics: If they push you to make quick decisions.

- No Fiduciary Duty: Advisors who are not fiduciaries may not prioritize your best interests.

The Importance of Communication in Financial Planning

Building a Strong Advisor-Client Relationship

A successful relationship with your financial advisor hinges on effective communication. Here’s how to ensure a strong partnership:

Regular Check-Ins and Updates

- Schedule regular meetings to review goals and investment performance.

- Discuss any significant life changes that may impact your financial plan.

Feedback and Adjustments

- Provide honest feedback about your comfort level with investments.

- Be open to making adjustments based on performance and changes in your life.

Cost of Financial Advisory Services

Understanding AUM Fees vs. Flat Fees

The cost of hiring a financial advisor can vary widely. It’s essential to understand the differences between fee structures:

Hourly Rates and Subscription Fees

- Hourly Rates: Charged for specific services, often suitable for those who need occasional advice.

- Subscription Fees: Monthly fees for ongoing access to financial advice.

Final Thoughts on Finding a Financial Advisor

Key Takeaways

- Assess your financial situation before searching for an advisor.

- Understand the types of advisors available, including fiduciary and non-fiduciary.

- Evaluate potential advisors thoroughly by asking the right questions and watching out for red flags.

Resources for Further Research

YouTube Video: How to Choose a Financial Advisor

Frequently Asked Questions

1. How do I know if a financial advisor is right for me?

Consider their qualifications, experience, and if their services align with your financial goals.

2. What should I look for in a financial advisor?

Look for credentials such as Certified Financial Planner (CFP) designation, fiduciary duty, and positive client reviews.

3. How much should I expect to pay for financial advisory services?

Fees can vary significantly, so it’s important to understand the advisor’s fee structure before proceeding.

In conclusion, finding the right financial advisor can significantly impact your financial journey. By understanding how to find a financial advisor, assessing your needs, and evaluating potential candidates, you can ensure that you choose a professional who can guide you toward achieving your financial goals.

Add Row

Add Row  Add

Add

Write A Comment